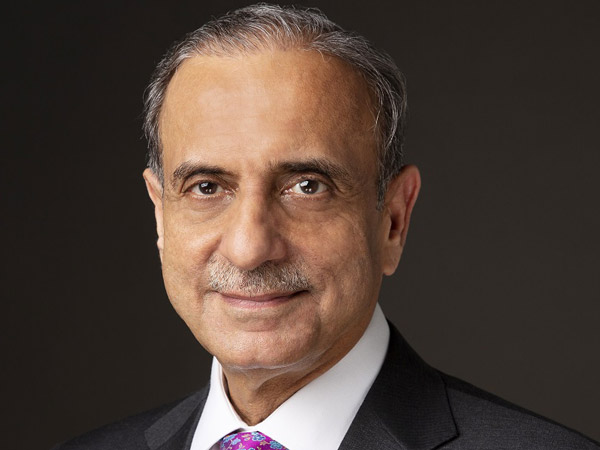

How JPMorgan’s Daniel Pinto earns $687k a month in cash

With pay totaling $24m, Daniel Pinto, who’s just been made sole president of JPMorgan alongside his role as CEO of the corporate and investment bank, is paid very handsomely for his pains. And as a reminder, Pinto’s pay is disproportionately cash.

JPMorgan’s 2021 proxy report reveals that $8.2m of Pinto’s $24m pay package for 2020 has consisted of his salary (denominated in dollars, but paid in GBP). Another $16.2m was Pinto’s restricted stock bonus.

Pinto receives $687k in cash from JPMorgan on a monthly basis, amounting to £24k ($34k) a day, presuming that he works a five-day week.

This is lavish by anyone’s standards, including JPMorgan’s: other executives at the bank get significantly smaller amounts of their pay as cash.

JPMorgan CEO Jamie Dimon, for example, received $31.5m last year in total. However, Dimon’s salary and cash payments made up only $6.5m of this, with the remainder paid as performance share units (PSUs). JPMorgan’s PSU’s vest over three years and only pay in full if JPMorgan’s return on tangible equity substantially exceeds 6%.

By comparison, Pinto’s $8.2m in cash is paid even JPMorgan’s stock falls in value or the bank’s return on tangible equity plummets.

Pinto’s pay is a perk of his location. Because he works out of London and London is still abiding by EU pay rules, Pinto’s pay is governed by the European Union’s Capital Requirements Directive IV, which caps bonuses at no more than twice salaries.

Pinto, therefore, owes his very generous cash payments to the fact that he’s not in New York. And he might want to stay in London as a result.

2 Comments

It’s no secret that the digital industry is booming. From exciting startups to need ghor

global and brands, companies are reaching out.

It’s no secret that the digital industry is booming. From exciting startups to need ghor hmiu

global and brands, companies are reaching out.